Contents:

Unsystematic risk is the risk that occurs because of a company’s operation, while systematic risks are those occurring in the market that cannot be avoided by diversification of stocks. Explore how each type of risk is evaluated and the significance of diversification in an investment portfolio. In most instances, both systematic and unsystematic risks become easy to mitigate with the proper execution of risk management strategies. Understanding systematic risk and how it compares to unsystematic risk can help with making more informed decisions as an investor. It can also help to put into perspective the types of things that may affect your portfolio’s returns in the short and long term.

Find out if your business can survive well without certain expenses which you are incurring. For instance, you find out that outsourcing some occasional work is better than hiring full-time employee for the work. In the step above, ranking the risks based on the severity will help you treat the most severe ones at the earliest.

Does the Capital Asset Pricing Model Work? – HBR.org Daily

Does the Capital Asset Pricing Model Work?.

Posted: Fri, 07 Nov 2014 00:08:03 GMT [source]

A strategic risk may occur if a business gets stuck selling goods or services in a dying industry without a solid plan to evolve the company’s offerings. A company may also encounter this risk by entering into a flawed partnership with another firm or competitor that hurts their future prospects for growth. In the current environment, there is a rush to develop electronic cars, for example, opening up a whole new field of competition within the auto industry. A business that is involved in developing new medicines, for example, faces higher business risk compared to a company that provides utility services.

Everything You Need To Master Financial Modeling

The reduction in unsystematic risk through diversification can reduce the variability in your portfolio returns. Unlike systematic risk, unsystematic risk can be reduced specifically through diversification. Or say a carmaker determines that a manufacturing flaw necessitates a recall of one of its vehicles. The company could assess the financial damage that may result from the recall and look for opportunities to recoup some of those losses. In that situation, the company has a measure of control over outcomes making this a form of unsystematic risk. Unsystematic risk is caused due to internal factors; it can be avoided and controlled.

For example, a stock market crash would likely harm Tesla’s shareholders, along with many other companies. A shortage of silicon chips or lithium could affect the entire technology sector, including Tesla. Investors can reduce their exposure to unsystematic risks by diversifying their portfolio.

How to Reduce Unsystematic Risk

A strategic risk may occur if a business gets stuck selling goods or services in a dying industry without a solid plan to evolve the company’s offerings. It can be mitigated through diversification, and so is also known as diversifiable risk. The nature of risk in cases unsystematic is not repetitive, and most of the time, there is an evolution of new hazards. The policymakers face challenges in resolving the risks as they have to deal with the utmost attention because of its nature. Specific risk in investing is any downside potential that is peculiar to a single company or sector.

If those municipalities were to change their policies, they would likely damage Tesla’s profits without affecting competitors. There are some political and legal risks that do affect entire industries in systematic ways, however. It is not always possible to diversify away risks outside of the control of individual managers. Unsystematic risk refers to risks that are not shared with a wider market or industry.

Now, we know that programs and effective measures can help mitigate operational risks. Usually, the analysts and investors consider a financial risk ratio, which is, Debt/Equity ratio. Will affect the stock/securities of a particular firm or sector, e.g., the strike caused by the Cement industry workers. Residual RiskResidual risk, also known as inherent risk, is the amount that still pertains after all the risks have been calculated. In simple words, this is the risk that is not eliminated by the management at first, and the exposure that remains after all the known risks have been eliminated or factored in. For example, if an American company invests in an Indian company, it will be considered a foreign investment.

Unsystematic risks occur in the case of large portfolios or funds under management. Due to low harvesting conditions across Europe, commodity prices have jumped up, followed by a slump in demand and reduced yields for the farmers. It is a pure case of unsystematic risk, and the matter is related to the agricultural segment in Europe only. So, the portfolio manager can divert the funds exposed to the agricultural industry. The funds can be diverted to US consumption, as the sector has been going very strong recently. Unsystematic risk is the risks generated in a particular company or industry and may not apply to other industries or economies.

What Is Systematic Risk?

Smart investors understand how to reap the benefits of these emerging probabilities or risks. Similarly, if other sectors are playing poorly in the market, and ‘one industry’ is enjoying a boost in its return, it can provide profitable results to the investors. The origin of these risks can stem from both external and internal factors emerging within a business firm or a company. The way that a business chooses to fund its assets is called its capital structure. The scale of operation is lower than the systematic risk; thus, the government’s involvement is also less. The private enterprise has to resolve the matter most of the time as it does not impact the larger section of the economy.

- Sure, you might argue that some of these risks give competitors a competitiveadvantage, but in this context, we’re only really focusing on the adverse effects of risk.

- Systematic risks are unavoidable in nature whereas unsystematic risks are avoidable in nature.

- However, that’s not exactly true when discussing systematic and unsystematic risks as they function in different ways.

- The profitability may be impacted due to the series of disruptions to the business.

Financial risk is the risk of a company where the company is unable to manage its finances and goes bankrupt because of liquidity risk, market risk. Diversification Of A PortfolioPortfolio diversification refers to the practice of investing in a different assets in order to maximize returns while minimizing risk. This way, the risk is kept to a minimal while the investor accumulates many assets. E.g., Mr’ A’ has made a portfolio constituting 500 shares of a Media company, 500 Corporate bonds, and 500 Government bonds.

Neither of these specific political or legal risks is inherent to the industry itself. If an investor purchased stock in all three firms, they may be able to diversify away losses in Firms B and C via the gains from Firm A. Unsystematic risks are often specific to an individual company, due to their management, financial obligations, or location. While investors may be able to anticipate some sources of unsystematic risk, it is nearly impossible to be aware of all risks.

Risk-Reward Ratio: What it is + Why it Matters when Trading – ig.com

Risk-Reward Ratio: What it is + Why it Matters when Trading.

Posted: Mon, 23 May 2022 17:03:22 GMT [source]

Investors can somewhat mitigate the impact of systematic risk by building a diversified portfolio. The Oxford Dictionary defines risk as the exposure to danger, harm, or loss. When we talk about risk in the financial markets, we are using the loss part of that definition, in terms of money we might lose. We can lower it, mitigate it, and otherwise make sure it doesn’t define our investments, but there will always be some risk whenever we are seeking to obtain a financial reward. The risk highlights the possibility of a collapse of the entire financial system or the stock market, causing a catastrophic impact on the whole system in the country.

While some of these risks may be fairly common, they are not evenly distributed across the entire market. For this reason, unsystematic risks can be broad enough to apply to many different businesses at once. What is important is that an unsystematic risk is not inherent to every security or at least not a great majority of securities. Moreover, investors should be able to diversify away unsystematic risks by strategically targeting a wide enough range of holdings in their respective portfolios. To reduce unsystematic risk through diversification, you need to create a portfolio of securities whose returns are negatively correlated.

Unsystematic risk, in this case, affects not only specific airlines but also several of the industries, such as large food companies, with which many airlines do business. In this regard, the investor could diversify away from public equities altogether by adding U.S. Treasury bonds as additional protection from fluctuations in stock prices. Therefore, through diversification, Margaret spreads the investment over different classes of assets, thus eventually realizing a growth of 16.26% YoY.

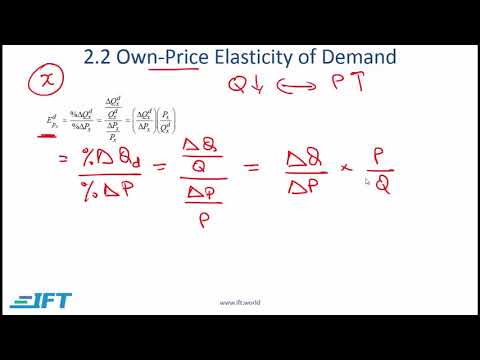

In this case, the company in a new or volatile industry has less certainty for success and guaranteed revenue. This is ultimately because, under the CAPM, theonly factor that affects expected returns of securities is the overall market portfolio. However, we do have an article on estimating total risk and another one on calculating systematic risk. The risk that any individual shareholder would be exposed to is Systematic Risk, no matter whether it’s a diversified investor who owns a large number of stocks or an investor who holds only one stock. Unsystematic risk, or diversifiable risk, is typically contrasted withsystematic risk. CAs, experts and businesses can get GST ready with ClearTax GST software & certification course.

Due to a recent strike by the workers of the particular region, the manufacturing plant is closed, and the production activities are stopped for a while. But the demand for automobiles is the same, and the overall economic growth is intact. Risk takes on many forms but is broadly categorized as the chance an outcome or investment’s actual return will differ from the expected outcome or return. « Beginners’ Guide to Asset Allocation, Diversification, and Rebalancing. » Accessed Oct. 6, 2021. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Read our editorial process to learn more about how we fact-check and keep our content accurate, reliable, and trustworthy.

A simple example of unsystematic risk is litigation risk, meaning the danger that a company might face legal action. For example, a company whose products are more likely to be defective will face more class-action suits than other companies in the same industry. For example, an investor, who owned nothing but airline stocks, would face a high level of unsystematic risk .

Beta is a measure of the volatility, or systematic risk, of a security or portfolio in comparison to the market as a whole. Systematic risk underlies other investment risks, such as industry risk. For example, if an investor has placed too much emphasis on cybersecurity stocks, it is possible to diversify by investing in a range of stocks in other sectors, such as healthcare and infrastructure.

Or if you anticipate interest rate hikes, you might adjust your bond holdings to reflect that. If you want to know how much systematic risk a particular security, fund, or portfolio has, you can look at its beta, which measures how volatile that investment is compared to the overall market. A beta of greater than one means the investment has more systematic risk (i.e., higher volatility) than the market, while less than one means less systematic risk (i.e., lower volatility) than the market. Even diversification can’t protect you completely against unsystematic risk; it will always be a concern. Systematic risks are difficult to be mitigated since these are inherent and not necessarily controlled by an individual or a group. Still, as an investor, one can consider diversification into various securities to perhaps reduce the impact of distinctive situations, causing a ripple effect of such risks.

You can utilize the help of a professional financial advisor in order to better understand what level of risk is right to help you meet your investment goals. Systematic risk can be mitigated through diversification, but the risk would still affect all investments in a particular market or economy. Systematic risk refers to the risks inherent in an entire market or economy, rather than being specific to a particular company or industry. Systematic risk is the risk that’s produced as a result of external factors and affects the market as a whole.

Nevertheless, over the next year, the company realises that consumers are more inclined towards bigger phones and watches. Thus, the inventory and machinery the company obtained will later sell or remain unsold at a major loss. Hence, due to poor entrepreneurial foresight, all other firms in the technology sector could perform well, while this company will backtrack.