Contents:

If you wish to invest a lump sum, it is useful in calculating the compound annual growth rate of the various investment possibilities. If you invest at different times, using XIRR to make a judgement about your investments will provide you with more accurate results. You can also use the compound annual growth rate calculator to compare stock performance to that of peers or the industry as a whole. You can use CAGR calculator to find the return percentage in your investment over a time period. Be it mutual fund CAGR, Equity CAGR, FD CAGR, etc., one should analyse the CAGR return he/she will be achieving and whether it is sufficient or not.

Since the interest-on-interest effect can generate positive returns based on the initial principal amount, it has sometimes been referred to as the snowball effect of compound interest. These articles, the information therein and their other contents are for information purposes only. All views and/or recommendations are those of the concerned author personally and made purely for information purposes. Using a CAGR calculator enables you to receive a bird’s-eye view of the return on your investment.

What is a CAGR calculator?

Please note that your stock broker has to return the credit balance lying with them, within three working days in case you have not done any transaction within last 30 calendar days. CAGR tells us the rate at which an investment can grow over time. If an investment is growing at 10% CAGR, it means that the average annual growth of that investment is 10%. The CAGR Calculator would tell you how much annual returns an investment made over a number of periods.

Similarly, for small businesses, a CAGR of 15% to 30% is satisfactory. As a result, a promising CAGR does not always imply the highest CAGR; it can also mean stable and constant growth. CAGR should not be the only factor while making investment decisions in a stock of a company. You must do thorough research before deciding to take the plunge. CMGR calculates average monthly growth, similar to CAGR, which calculates average annual growth rate. The formula for calculating CMGR is the same; simply replace the number of years with months.

Benefits of using online CAGR Calculator

There’s nothing wrong with specifying that, but in the world of finances, the traditional way is to represent the annual returns in the form of compounded values. Direct MF plans are better than regular plans because they generate higher returns, have higher NAV, have no risk of mis-selling and give you full control of your investment. Investing in the US stock markets will let you in some of the best global companies. With the Kuvera app installed on your phone, you can easily access the US market.

https://1investing.in/ or a Systematic Investment Plan, wherein you plan your investments of a stipulated amount at specific intervals in pre-identified mutual fund schemes. The particular intervals are either on a monthly or quarterly basis. Read all the scheme related documents carefully before investing. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment.

Simple Interest Calculator

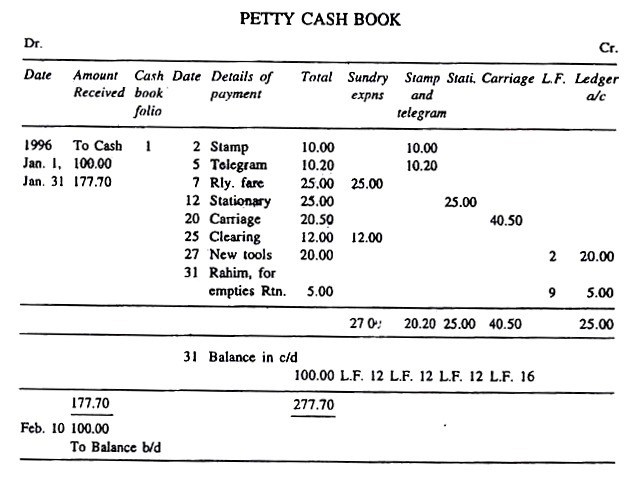

Systematic Investment Plan is a kind of investment scheme offered by mutual fund companies. Using SIP one can invest small amount peridically into a selected mutual fund. For retail investors, SIP offers a well disciplined and passive approach to investing, to create wealth in long term . Since, the amount is invested on regular intervals , it also reduces the impact of market volatility. The compound annual growth rate displays the return on your investment over time. All mutual fund performance for periods exceeding one year are expressed in CAGR.

You may wish to input your investment’s initial and final values. If the sales revenue of a company is 5%-10%, then the company has a good CAGR. CAGR is the ideal metric required to calculate the growth potential of the company.

To read the complete definitions as stated by IRDAI and displayed across this website, you can refer thespecimen policy documents. Principal and interest growth is quick that increases at a fast pace. The principal keeps changing due to the addition of accumulated interest during the period. Attention Axis Direct Investors Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 1, 2020.

Calculating Mutual Funds Returns – Deccan Herald

Calculating Mutual Funds Returns.

Posted: Tue, 21 Feb 2023 08:00:00 GMT [source]

Most importantly, you can compare your CAGR returns with your cost of capital to assess the risk-reward profile of your investments. Tax Harvesting is a technique that involves benefitting from LTCG tax on equity funds. Long-term capital gains earned from equities and equity-related investments are taxable at a 10% rate on returns above Rs. 1,00,000 in a financial year. If you sell and buy back part of your investments every year, you can save on taxes. This utilises the ₹1 Lakh annual LTCG exemption by selling and buying back part of your investment such that you “realise” gains and not pay taxes on the exempt Rs 1 Lakh of LTCG. At Kuvera, we monitor your portfolio and recommend a transaction when applicable.

Metal Weight Calculator

Our app makes it easy for you to choose the best-performing US stocks. To take a look at the day’s top gainers and losers, visit the ‘Invest’ section of the Kuvera app and click on US Stocks. CAGR does not take into consideration the inherent risk of an investment.

It can also be used to analyse an investment’s performance, compare stocks or mutual funds, and even track business performance. Using the CAGR calculator, you can compare the yearly growth rate to a standard return. You can use the calculator to determine the rate of return on your investment, for instance, if you have an equity fund that has increased in value over time. The computations in this application employ the compound annual growth rate formula . The CAGR calculator helps you to calculate the returns from your mutual fund investments.

In regular plans, you pay commissions to the broker or the distributor, which can be as much as 1.5% of the value of your holding, every single year. This 1.5% leakage can make a huge difference, if you look at the compounded value over years. By investing in Direct Mutual funds, you save this commission every year. If you compare an investment of Rs 1 lakh in a Direct Plan and a Regular Plan, your investments will be worth 35% more in just 20 yrs when you invest in Direct Plans.

If the compounding was done on a half-yearly basis, he would end up with ₹ 12,314 and if it was done on a monthly basis, he’d end up with ₹ 12,293. The online CAGR Calculator is used to compute the compound annual growth rate or CAGR. A SIP averages your total investment cost throughout the investment. It offers you the flexibility to select your investment plan as per your financial threshold. HDFC provides the option to know your return before investment with theSIP return calculator.

- The size of a company and the industry sector in which it operates influence its growth rate.

- Please write the Bank account number and sign the IPO application form to authorize your bank to make payment in case of allotment.

- CAGR Calculator is free online tool to calculate compound annual growth rate for your investment over a certain time period.

- It is only appropriate for a one-time investment as a lump sum.

This is one of the most accucagr calculator india methods of calculating the rise or fall of your investment returns over time. CAGR formula takes into account the impact of time and compounding. As an investor, you can decide how much to invest now to achieve a specific investment goal over time. You can also use CAGR to compare multiple investment products and how they have performed over a period of time. CAGR shows you the mean annual growth rate of your investments over a period of time which is above one year.

Kuvera’s CAGR calculator comes in handy while calculating returns of various investment options. For example, two companies A and B, the performance of each company’s stock over a period of time can be easily compared based on their CAGR. CAGR depicts average growth rate over the years on an investment or loan when it is compounding.

Once the investor knows the CAGR results, it is easy to compare the returns from the investment against a chosen benchmark to further analyse the investment decision. It means expressing a return in such a way that the return builds on itself every year. If you’ve invested a lump sum in mutual funds for more than a year, you can use the Kuvera’s CAGR calculator.