Its pre-approval process can be completed in as little as three minutes and won’t impact your credit score. To refinance your mortgage, you don’t need to go back to the bank or lender you initially worked with (more on that below). It’s best to compare interest rates and closing costs from at least three refinance lenders, considering each lender’s credit score, equity and other requirements and how those might apply to your circumstances. The average rate for a 15-year, fixed mortgage is 6.63%, which is an increase of 8 basis points from the same time last week. Compared to a 30-year fixed mortgage, a 15-year fixed mortgage with the same loan value and interest rate will have a bigger monthly payment. But a 15-year loan will usually be the better deal, as long as you can afford the monthly payments.

- A gleeful homeowner may gloat about vanquishing the competition in a bidding war, but they won’t mention the sale price, or their monthly payments.

- That said, it’s possible to qualify for a mortgage refinance with a DTI ratio up to 50%, but your rate may be higher.

- Fifteen-year refinance rates are lower than 30-year refinance rates.

- The APR is the all-in total of your mortgage costs, which can vary by lender, and will include your closing costs if rolled into your loan.

- « FHA mortgages can be a wonderful option if you have a lower credit score. It also opens up mortgage availability to those with higher debt-to-income ratios. »

As with any other form of credit you apply for, applying for a mortgage refinance means the lender will run a hard inquiry on your credit. However, making on-time monthly payments and avoiding applying for too many new lines of credit all at once can help your credit score recover. As with its home purchase loans, Ally Bank’s mortgage refinances don’t come with lender fees. In other words, borrowers won’t pay application, origination, processing, or underwriting fees.

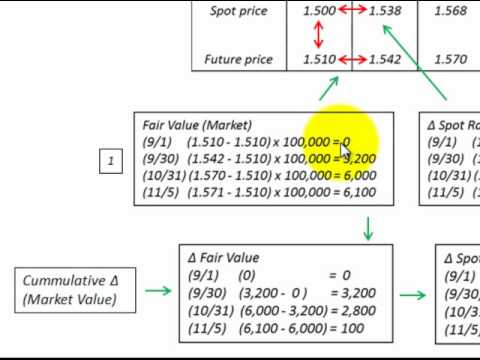

How a 30-Year Refinance Impacts Your Mortgage

They also meet underwriting guidelines set by Fannie Mae and Freddie Mac, the government-sponsored entities that buy conforming loans. The most recent housing forecast from Fannie Mae calls for the average 30-year fixed mortgage rate to close out the year at around 6.6%. « Mortgage rates will continue to ebb and flow week to week, but ultimately, I think rates will stick to that 6% to 7% range we’re seeing now, » said Jacob Channel, senior economist at loan marketplace LendingTree.

If your objective is to save money, then your new refinance rate should be low enough to offset the cost of acquiring the loan. Use a mortgage refinance calculator to determine the refinance interest rate that would make it financially worthwhile. Refinancing a mortgage can be expensive and typically costs between 2% to 6% of the loan balance in closing costs.

Best Lenders To Refinance a Mortgage

One common misconception is that refinancing is free or that it costs the same with every lender. And this isn’t the case at all — borrowers should expect closing costs in the thousands when refinancing. To be sure, this can still be well worth it if you’re planning to stay in your home long enough so that the savings outweigh the cost. Once you determine what your needs and preferences are, get started by comparing mortgage rates and finding a lender in your area through Bankrate.

You should refinance your mortgage when rates fall below the rate you are paying, but what if rates keep falling? That is not an easy question to answer because when you refinance you may get a better interest rate, but refinancing costs money. There are appraisal fees, closing costs, title fees, escrow fees, and sometimes points. Also, when you refinance there is a good chance your credit score will drop, as « new credit » and « credit inquiries » are two things that negatively affect your credit score. Also, when you do refinance the underwriter wants to see your previous loan « seasoned » which means you have made the payments on time for a certain period. Depending on the underwriter, that could be anywhere from six to 12 months.

How to refinance your current mortgage

As you compare lenders, you might come across some that charge a flat fee for refinances. This could translate to more savings, depending on how much you’re borrowing and whether there are other fees. By following these tips above, you can increase your odds of getting better refinancing rates and overall loan terms. In some cases, achieving these increases is a matter of letting time pass. Conforming conventional mortgages fall within certain dollar amount limitations set every year by the Federal Housing Finance Agency.

- You can check current mortgage rates to see the average of what lenders are offering.

- The better your credit score, the better the rate you’ll get on your mortgage.

- Mortgage rates move around on a daily basis in response to a range of economic factors, including inflation, employment and the broader outlook for the economy.

- When you refinance your home loan, you pay off your existing mortgage with funds from the new loan, which means you will have a new loan note.

- This could save borrowers anywhere from hundreds to thousands of dollars in closing costs.

Getting preapproved for a mortgage will show real estate agents and sellers that you’re a serious buyer. It’s smart to get preapproved and then get Loan Estimates from more than one lender. The Loan Estimate provides details about the loan terms, monthly payment and estimated closing costs. With those pieces of information, you can compare offers and choose the best deal.

When you refinance your mortgage, you’re basically trading your current mortgage for a new one.

The process of refinancing your mortgage follows similar steps to acquiring your initial mortgage. When you’re shopping around, be sure to ask about any discounts—including appraisal waivers—that might be available to you. Some financial institutions offer discounts to existing customers; you might also find military discounts.

Intercontinental Exchange, Inc. (NYSE:ICE) Q2 2023 Earnings Call Transcript – Yahoo Finance

Intercontinental Exchange, Inc. (NYSE:ICE) Q2 2023 Earnings Call Transcript.

Posted: Fri, 04 Aug 2023 21:58:38 GMT [source]

A cash-in refinance can be a valuable option for homeowners who want to reduce their monthly mortgage payments or lower interest costs. With a cash-in refinance, you put a lump sum payment toward your existing mortgage balance at closing, which reduces your loan-to-value (LTV) ratio and increases the equity in your home. This can also help you qualify for better loan terms as lenders may view you as less of a risk. Homeowners still have time to lower their monthly mortgage payments by refinancing, as mortgage rates are still relatively low. The time to shop for a mortgage lender is before you start house hunting.

When you are ready to apply for a loan, you can reach out to a local mortgage broker or search online. In order to find the best home mortgage, you’ll need to take into account your goals and current finances. But in most cases where only the interest rate is changed, the rate should be at least 0.50 percent lower than your current rate. The Ascent is a Motley Fool service that rates best mortgage refi lenders and reviews essential products for your everyday money matters. If rates continue to decline and/or the homeowner can use the equity in the home to improve the value of the property, then there may be multiple opportunities to refinance. Refinancing may also make sense if the homeowner can use the accrued equity in the house to reinvest in the house for maintenance and upgrades.

Keep in mind that mortgage rates in general have more than doubled since the start of 2022. Other lenders offer so-called “no closing cost” refinances that allow you to finance these fees with the new loan instead of paying them upfront. While this can be a nice perk if you don’t have the savings, you’ll pay a higher interest rate in exchange for it. The offers that appear on this site are from companies that compensate us. But this compensation does not influence the information we publish, or the reviews that you see on this site.

How To Refinance Your Mortgage – Forbes Advisor – Forbes

How To Refinance Your Mortgage – Forbes Advisor.

Posted: Fri, 12 Aug 2022 07:00:00 GMT [source]

Check out the big national lenders, but also check out local lenders and the bank or credit union at which you have a checking account. Make use of calculators to help you compare rates and to study the impact of « points » on your overall costs. A pitfall that is easy to overlook is that you can unwittingly end up paying far more interest if you continually refinance mortgages, even though you’ve lowered monthly payments.

The Federal Reserve adjusts the federal funds rate as part of its effort to control inflation. Once you’ve identified a lender, find out what paperwork you need in order to complete a refinance application. Among the requirements, your lender will want to review tax returns, pay stubs, W-2s and other proof of income, as well as documentation about any assets such as savings. Consumers have little control over what mortgage rate they get, aside from maintaining a solid credit rating.

Lenders also rely heavily on an applicant’s credit score and debt-to-income ratio when deciding whether to extend a new loan. Instead of refinancing, ask your lender about the possibility of mortgage recasting. Mortgage recasting is when your lender recasts—or recalculates—your loan based on the remaining term and outstanding balance.